This report analyzes current global pharmaceutical Research and Development (R&D), focusing on high investment levels, the concentration of activity in the United States (US) and China, and the specific emphasis on oncology and biotechnology. The analysis uses secondary research data and examines key funding trends, strategic priorities in major therapeutic areas, and the alignment of R&D spending with underlying disease dynamics.

Key Insights:

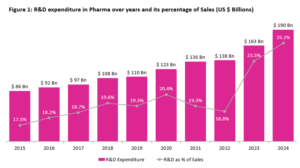

- High Investment Levels: Pharma R&D is supported by significant funding. Overall funding reached $102 billion in 2024 (up from $71 billion in 2023), a decade high. 1 This fuels global R&D spending, recorded at $163 billion in 2023 and estimated at $190 billion for 2024. 1

- US and China Lead: R&D activity is geographically concentrated. The US hosts approximately 55% of R&D headquarters,3 while China hosts approximately 14%, 12 making it the second highest, and is rapidly growing as a major R&D center.

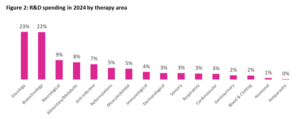

- Focus Areas: Investment is heavily directed towards oncology (anticancer research) and biotechnology, representing significant shares of the R&D landscape (approximately 23% and 22% respectively) and showing growth rates around 3% each in the recent 5 years. 2

Source : IQVIA – Global Trends in R&D 2025

Global R&D Landscape

Drug companies are getting a lot of money to help them research and develop new medicines. In 2024, the total funding for R&D reached $102 billion, the highest amount in ten years and a big jump from $71 billion in 2023. 1 This money comes from different places like investors (venture capital), selling shares on the stock market (IPOs), and deals between companies. It shows that investors have confidence in the future of the drug industry.

All this funding helps pay for more R&D spending worldwide. Global R&D spending hit $163 billion in 2023 and reached $190 billion in 2024 (as shown in Figure 1 above). 2 This substantial level of spending highlights the significant resources allocated to pharmaceutical innovation globally and enables the pursuit of complex research programs across diverse therapeutic areas and geographical regions.

R&D Investment by Therapy Area

When looking at where R&D investment is directed, spending is highly concentrated in a few key therapeutic areas. Anticancer research leads significantly, accounting for 23% of R&D spending. Biotechnology follows closely, representing 22% of the investment (as shown in Figure 2 below). 2 Together, these two areas make up nearly half of all R&D expenditures. The dominance of these two fields highlights a strategic focus driven by the significant unmet need, expanding scientific opportunities, and large market potential perceived specifically within oncology and biotechnology.

Source : Pharma R&D Annual Review 2024

Why is Oncology a Major R&D Focus Area?

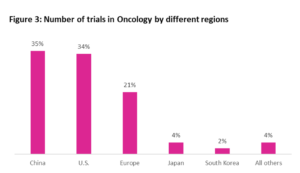

Cancer research commands a large and growing share of R&D spending, representing 23% of the total market. Several key factors drive this focus globally. Cancer represents a significant mortality burden, being the second leading cause of death worldwide and accounting for 14.57% of global deaths in 2021.4 Regionally, oncology R&D focus is particularly strong in China (35% share) and the US (34% share), as shown in Figure 3 below. Furthermore, rising cancer incidence is strongly linked to aging populations, a major demographic trend affecting R&D priorities in both the US and China (where cancer rates among those over 55 years old reportedly tripled between 1990 and 2019). 7 Governments also prioritize cancer research through national health strategies; for example, US National Cancer Institute (NCI) funding correlates with incidence and mortality data,6 and China lists cancer as a high priority under its Healthy China Action Plan (2019-2030).7 Finally, the substantial global oncology market, with spending exceeding $218 billion in 2023,11 provides strong commercial incentives that complement the pressing clinical need.

- US Strategic Focus in Oncology:

The US puts a lot of money into fighting cancers that are common there, like lung, breast, colon, and prostate cancer, overall contributing 34% of the global oncology research as shown in Figure 3 below.10 It also focuses heavily on preventing cancer and finding it early, knowing that better screening could save over 15,000 lives each year. 6 The intense focus on oncology is evident in the R&D pipeline, with cancer indications representing 83% of total drugs in the pipeline among the top 10 disease areas. 2

- China Strategic Focus in Oncology:

China focuses its R&D on cancers that are very common in its own country, like stomach, liver, and esophageal cancer, overall contributing 35% of the global oncology research as shown in Figure 3 below. These cancers comprise about half of the world’s cases. 5 Like the US, China’s R&D pipeline shows a strong oncology focus, with cancer indications representing 91% of total drugs in the pipeline among the top 10 disease areas. 2 Their R&D is pushed by factors like more older people, more people living in cities, lifestyle changes, and expected increases in cancer deaths. 5,7

Source : IQVIA – Global Oncology Trends 2024: Outlook to 2028

Biotechnology R&D Focus

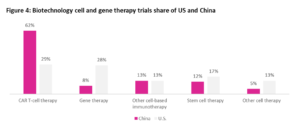

Biotechnology is the second major driver of growth within the pharmaceutical sector, representing 22% of the R&D spending and growing at around 3% over the past 5 years. This expansion is fueled mainly by technological advances and breakthroughs in innovative platforms such as CAR T-cell therapy, gene therapy, stem cell therapy, and other sophisticated immunotherapies.8 Much of this cutting-edge innovation directly feeds into and supports the oncology pipeline, offering new therapeutic options for hard-to-treat hematologic malignancies (blood cancers). As the US holds the dominant global market share in biotechnology (59%) followed by China (11.3%), the subsequent sections will examine the specific strategic approaches these two leading nations are taking in this rapidly evolving field.13

- US Strategic Focus in Biotechnology:

The US maintains a leadership position in the global biotechnology market, holding 59% market share in 2021.8. It supports a diverse R&D portfolio, investing in advanced platforms like CAR-T, having a 29% market share, and gene therapy, contributing 28% across multiple therapeutic areas (as shown in Figure 4).8 Key areas include oncology (both solid tumors and hematologic cancers, with around 187,000 new US cases estimated in 2024)9, immunology, and neurology. Despite its strengths, the US faces challenges related to treatment resistance and ensuring equitable access to these advanced therapies.

- China Strategic Focus in Biotechnology:

China’s biotechnology sector is experiencing rapid growth, capturing about 11.3% of the global market share in 2021, making it the second largest.8 There is robust investment in CAR-T cell therapy, representing a primary focus (62% of relevant trials as shown in Figure 4), positioning China as a leader in this specific domain.8 The country’s biotech R&D aligns strongly with its national oncology priorities, targeting prevalent solid tumors and hematologic cancers. A primary goal remains improving nationwide patient access to these innovative treatments.

Source : Strengthening Pathways for Cell and Gene Therapies

Is the spending justified?

- Mortality Impact: Spending correlates strongly with cancer’s high global mortality ranking, as it accounts for 15% of global deaths, making it the second leading cause. This reflects the urgency to address diseases with such severe outcomes. 4

- Incidence Trends: Investment aligns with rising incidence driven by aging demographics in key R&D hubs (US and China). The link is clear, with cancer rates among older populations (55+) tripling in China over recent decades, indicating a direct response to these growing patient populations. 5

- Health Priorities: The direction of R&D spending is consistent with national health strategies and funding patterns, as seen in the US NCI’s portfolio emphasis and China’s designation of cancer as a priority in its Healthy China Action Plan, indicating alignment with public health goals.6, 7

- Market Dynamics: The large commercial market provides viability alongside clinical need. The global oncology market surpassed $218 billion in 2023 and is projected to see continued strong growth. 2

While other conditions (e.g., neurological diseases) may have high prevalence, current R&D spending patterns suggest that the combination of high mortality impact, significant unmet need, promising scientific opportunity, and substantial market potential collectively drives investment decisions, leading to the concentrated focus observed in oncology and biotechnology. This interplay underscores how both clinical imperatives and economic factors shape the direction of pharmaceutical innovation.

Key Takeaways

In summary, global pharma R&D is seeing record funding, with the US and China receiving the largest share of this funding, and investment focusing heavily on cancer and biotechnology. The strong focus on cancer makes sense because of high death rates, aging populations, government goals, and large market potential. Biotech is growing fast due to new technologies that often help fight cancer. Both the US and China are focusing their efforts based on their own country’s health needs. Understanding these trends is crucial for anyone working in the pharma industry.

Looking for economic independent sub-contractors to collaborate on your next project? Look no further—Stratkalytics provides end-to-end Go-to-Market (GTM) and Pricing analytics offshore services, empowering consulting firms to deliver high-impact solutions for their clients at a 3x economical price than onshore consultant.

Sources:

- https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/global-trends-in-r-and-d-2025

- https://www.citeline.com/-/media/citeline/resources/pdf/white-paper_annual-pharma-rd-review-2024.pdf

- https://www.ispor.org/docs/default-source/intl2024/j-j-access-policy-research—ispor-2024—pharma-r-d-ecosystem-investment137860-pdf.pdf?sfvrsn=d28181d4_0

- https://vizhub.healthdata.org/gbd-results/

- https://www.mckinsey.com/industries/life-sciences/our-insights/managing-chinas-growing-oncology-burden

- https://www.cancer.gov/research/leading-progress/research-portfolio

- https://jogh.org/2024/jogh-14-04014

- https://www.researchgate.net/publication/388221967_Strengthening_Pathways_for_Cell_and_Gene_Therapies

- https://www.grandviewresearch.com/industry-analysis/hematologic-malignancies-market

- https://www.businesswire.com/news/home/20231226000730/en/USA-Solid-Tumor-Therapeutics-Market-Outlook-to-2028—Field-of-Oncology-is-Moving-Towards-more-Personalized-Treatment—ResearchAndMarkets.com

- https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/global-oncology-trends-2024

- https://www.mckinsey.com/industries/life-sciences/our-insights/the-dawn-of-china-biopharma-innovation

- https://www-statista-com.elibrary.siu.edu.in/statistics/1246614/top-countries-share-of-global-biotech-value/